New Englanders are pretty good at braving winter. They know which shovel to use for which kind of snow, which neighbor will need some help, and which grocery store sells out of milk first. But this coming winter feels different, and it’s shaking the confidence of even some of the hardiest Yankees because — from food to fuel — it feels like this winter could be an expensive one.

Recently announced winter electricity rates are nearly double what we saw this time last year. Those increases are in addition to other cost upticks in 2022 that go beyond just what is being seen in energy. As anyone who buys groceries or pumps gas can tell you, prices are rising economy-wide.

In terms of energy, NEPGA’s members have a unique understanding of, and insight into, this winter’s challenges. These companies, after all, provide nearly all of the electric generation to meet the needs of the region’s 14 million residents. Our members employ more than 4,000 people who operate, maintain, or otherwise support the power plants that power New England. We live here, work here, and are committed to helping New England thrive. Many NEPGA members are involved across the electricity supply chain including providing the energy for utility-administered default electricity supplies or direct to consumer retail offerings.

Why is this winter so different?

The biggest change from last year to now is the Russian invasion of Ukraine. In fact, it’d be hard to overstate the magnitude of the impact the war in Europe has had on the logistics and pricing of energy worldwide. In short, Russia controls a tremendous amount of fossil fuels — it is the world’s second-largest producer of natural gas (behind the United States) and met almost 40% of European Union natural gas demand in 2021.

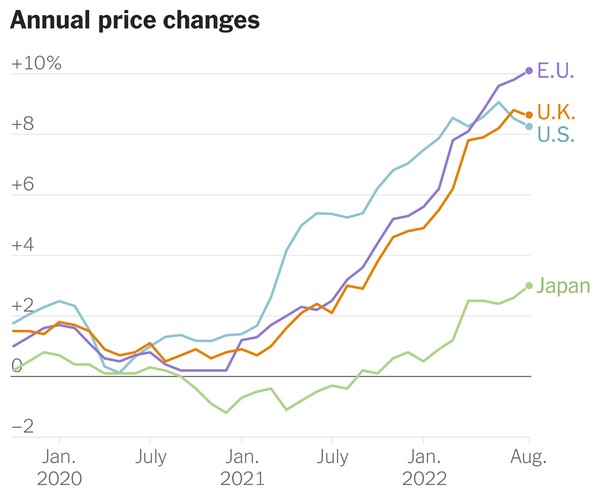

Because sanctions and other geopolitical activity have so significantly reduced Russia’s energy exports to Europe, the prices seen there and across much of the globe have gone much, much higher than historical norms.

In addition to the economic challenges this has caused, these tighter conditions — coupled with an already tight energy supply market in the region — have led ISO New England to signal concerns about the reliability of the electric grid in an extreme season, such as one where we see prolonged cold weather. The region’s largest utility, Eversource, has echoed many of these concerns in a letter to President Biden calling for exploration of emergency actions at the federal level and a whole of industry and government coordinated response. NEPGA, of course, stands ready to work with all our partners to meet the challenges of the moment

Recent updates, however, paint a more optimistic picture with the ISO, as the market operator for New England, noting confidence in a reliable electricity system under most winter weather conditions. Federal regulators reached a similar conclusion in a recent report, stating that New England’s electricity supplies are “sufficient to meet an extreme winter peak load.”

Where does New England fit in this global situation?

For years, natural gas has been a significant and growing source for electricity generation and heating in New England. The relationship between energy commodities and the region’s electricity grid is so tightly interconnected and interdependent that any significant event or disruption in almost any place on Earth (such as a cold snap in Montreal, a tsunami in Japan, or a war in Europe) can have a surprisingly disproportionate impact on energy prices.

With natural gas in particular, New England faces a unique issue compared to the rest of the United States. This region relies significantly on the import of natural gas for electric generation and home heating needs. This reliance is particularly acute in prolonged cold spells. Although most of the natural gas used in New England comes via domestic pipelines, some of the most critical supplies are delivered in the form of Liquified Natural Gas (or “LNG”), on ships from around the world via a handful of ports in Massachusetts and New Brunswick. New England relies on LNG most in times of extreme cold, when prices are typically high. The war in Europe and reduced supply of natural gas from Russia to Europe has driven that critical commodity to higher prices.

In fact, the cost to buy a shipment of LNG has been so high for much of 2022 that it has set records, with extreme price effects as a result. In Germany, electricity rates have increased more than ten-fold. Here again, however, the picture has improved in just the last few weeks as both European and global natural gas prices have eased, mild fall weather has hit much of the northern hemisphere, and fuel inventories in New England and Europe have increased.

And while natural gas prices are the ones most acutely affected by the ongoing international upheaval, the global constraints and price jumps are hitting everything from fuel oil deliveries to battery storage projects to offshore wind development. That includes those right here in New England. For example, Avangrid has informed Massachusetts regulators that their Commonwealth Wind project is no longer viable at the prices they initially bid in the state’s procurement process. The developer has also indicated that other projects, like Park City Wind for Connecticut, face similar challenges in meeting delivery timeline and price commitments.

What do we do going forward?

Over the last several years ISO New England has described “precarious” operating situations that could arise in the winter, in part because of constrained natural gas deliveries and a changing power generation fleet.

The unease leading into this winter is shining a necessary spotlight on issues of reliability and affordability. These concerns are gaining broader attention, too. On September 8, the Federal Energy Regulatory Commission held a public forum in Vermont to discuss the electric grid and markets in New England, as well as the particular challenges the region faces during the winter months. The general conclusion in that forum was that New England must redouble its focus on electric reliability and ensuring energy security for the region.

NEPGA agrees.

In collaboration with ISO New England and stakeholders across the region, NEPGA’s members have been working on ways to better align the wholesale electricity markets with the massive changes anticipated for the region’s grid and economy. Better alignment will support more investment in the electric generation sources – both new and existing – that are needed to reliably serve the region. An example of such efforts is the “Resource Capacity Accreditation in the Forward Capacity Market” project, which will establish methodologies that more accurately reflect the unique reliability contributions of each type of electricity generation. Another is the “Day-Ahead Ancillary Services” project, which will enable the ISO to more effectively and efficiently plan its daily grid operations. These market reforms are important but will take time – maybe years – to implement.

Ok, but what about right now?

There is no question that these times are challenging, but we want to emphasize that New England’s power generators have faced tough conditions before and are preparing for them now.

Through several winters, both mild and bitterly cold, New England’s power plants have met their obligations. This is true across all generation types, from fossil fuel and renewables to nuclear plants. NEPGA’s members conduct extensive tests, carefully maintain and update equipment, and thoughtfully manage fuel deliveries and supplies. We are committed to meeting our obligations as cost-effectively and efficiently as possible and know how much the people and businesses of New England are relying on us to do our jobs.

As our members prepare, we recognize that many consumers are facing difficult choices. Retail energy default rates set over an unprecedentedly volatile year are being locked in across New England.

We encourage households and businesses to explore all available options for managing the price increases they are facing. For some, that may mean working with a competitive supplier, for others it means weatherization or applying for bill support. With unsettled geopolitics, an uncertain economic outlook, and major changes to the electric grid all happening together, the challenges we face this winter could very well persist.

But NEPGA does not believe that this winter’s challenges are a reason to stop the goal of a heavily decarbonized economy. For years, we have been engaged in efforts to harmonize the wholesale electricity markets with the states’ decarbonization efforts. As those efforts continue, we must also meet the challenges of today.

For our part, electricity generation companies are focused on the priorities of reliability, affordability, and sustainability. Getting that balance right will require collaboration between generators, policymakers, consumers, and others. We look forward to continuing to evolve this most important of markets for a stronger future.

With the calendar quickly turning to 2023, New England’s generators will be on the job to power the households and economy.